To document unearned revenue, you generally have to enter the quantity in two places – as a credit score to your unearned revenue account and a debit to your cash account. This reveals that you’ve got got acquired money unearned revenue however nonetheless owe the client items or providers in return. At the end every accounting period, unearned revenues have to be checked and adjusted if needed. The adjusting entry for unearned revenue relies upon upon the journal entry made when it was initially recorded.

Once the automobile is constructed and handed over, the corporate can acknowledge the $5,000 as earned revenue. And so, unearned income should not be included as revenue yet; quite, it is recorded as a liability. This liability represents an obligation of the company to render providers or ship items in the future. It might be acknowledged as income solely when the goods or companies have been delivered or rendered. When a enterprise receives payment prematurely, it debits money and credits deferred income. This deferred income account is paired towards accounts receivable, representing future performance obligations.

This sort of income is cash https://www.quickbooks-payroll.org/ paid upfront to a company before it provides customers’ services or products. Adjustment entries are made when the services and products are delivered. When a business receives an advance cost, it must classify the amount as unearned income beneath liabilities, not earnings or asset. The cost represents a company’s obligation to ship a product or service in the future.

- For example, let’s say a company pays $2,000 for tools that is supposed to last four years.

- Salaries Expense will increase (debit) and Salaries Payable increases (credit) for $12,500 ($2,500 per worker × five employees).

- Cloud-based utility software program providers, health clubs, and the newspaper and magazine publication industries are examples.

- Unearned revenue, also referred to as deferred income or unearned revenues, refers to cash acquired by an organization for items or companies that have not but been delivered or carried out.

Step 1: Report The Preliminary Payment As A Liability

Your enterprise will want to credit one account and debit another account with the proper amounts utilizing the double-entry accounting method. Unearned revenue is a critical idea for companies to grasp, each from an accounting perspective and a strategic one. Cautious administration of unearned income is essential for accurate financial reporting, money move administration, and assembly customer obligations. At the same time, unearned revenue can provide useful alternatives for money circulate and growth when managed effectively as part of a company’s overall business strategy. Unearned income examples embody subscriptions, advance payments for products, retainer fees, and deposits for companies.

Securities and Exchange Commission (SEC) that a public company should meet to recognize income. Cautious evaluate and guide adjustments are key to monitoring deferred income under cash foundation accounting in QuickBooks. This section will clarify the double-entry bookkeeping methodology for recording deferred income transactions in QuickBooks. The curiosity she derives from her investment is taken into account unearned income and must be reported to the IRS for taxation on the ordinary income price. She additionally wins $10,000 on a recreation show, however she doesn’t get the full quantity of her winnings.

You cowl more particulars about computing interest in Current Liabilities, so for now amounts are given. Accrued bills are bills incurred in a interval however have yet to be recorded, and no money has been paid. Curiosity Receivable will increase (debit) for $1,250 as a result of interest has not yet been paid. Interest Income will increase (credit) for $1,250 as a end result of interest was earned within the three-month interval however had been previously unrecorded. Insurance policies can require superior payment of fees for a quantity of months at a time, six months, for example. The firm doesn’t use all six months of insurance immediately but over the course of the six months.

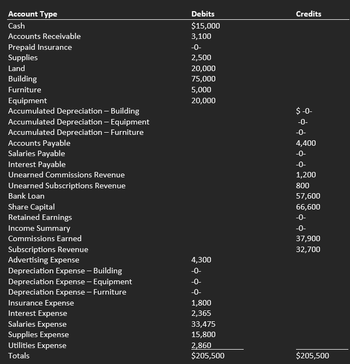

Balance Sheet

Baremetrics is a business metrics device that provides 26 metrics about your business, such as MRR, ARR, LTV, total prospects, and extra. To decide when you must acknowledge income, the Monetary Accounting Standards Board (FASB) and International Accounting Standards Board (IASB) introduced and introduced into force ASC 606. Baremetrics offers an easy-to-read dashboard that offers you all the necessary thing metrics for your business, including MRR, ARR, LTV, complete customers, and extra.

However, larger companies might have more complex systems for monitoring and managing unearned income because of the scale of their operations. Unearned revenue is usually recognised as earned income within a short period, normally less than a 12 months. Deferred revenue, however, may be recognised over an extended interval, spanning a quantity of accounting periods. Unearned income is an obligation, not an asset, and is recorded on a agency’s stability sheet.

A Couple Of Sensible Issues To Find Out About Deferred Income

Similarly, companies require buyer deposits for reservations, occasion bookings, or large purchases. If a customer cancels, the resort could hold part or all the deposit, relying on the cancellation coverage. This may be anything from a 30-year mortgage on an workplace constructing to the payments you should pay in the next 30 days. As a easy instance, imagine you have been contracted to color the four partitions of a building. Let’s take a look at how this works underneath the different accounting techniques. Hold prospects utilizing your service and head-off churn before it occurs.

Following this course of allows you to correctly report advance funds in QuickBooks while adhering to accrual accounting and revenue recognition ideas. Previously unrecorded service income can arise when an organization provides a service but didn’t yet invoice the client for the work. Since there was no invoice to trigger a transaction, an adjustment is required to recognize income earned at the end of the period. Supplies Expense is an expense account, increasing (debit) for $150, and Supplies is an asset account, reducing (credit) for $150.